Introduction:

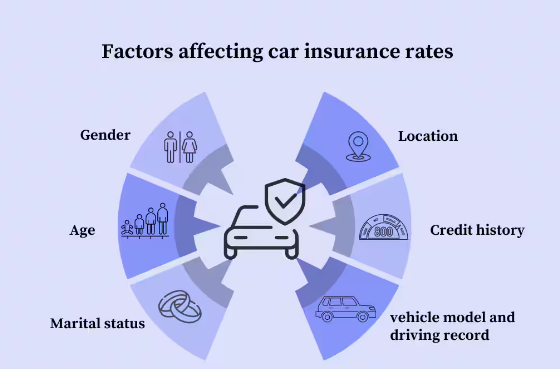

When it comes to auto insurance, many people assume that rates are determined solely by car-related factors such as the make, model, and year of the vehicle. However, the truth is that auto insurance providers consider a wide range of factors when calculating insurance rates. These factors go beyond the vehicle itself and take into account various personal and external elements that can affect the likelihood of an accident or the cost of a claim. In this article, we will explore the factors that auto insurance providers consider when determining insurance rates, shedding light on the complexity of this process. Car insurance quotes,Compare car insurance online,Buy car insurance online,Auto insurance,Commercial auto insurance,Small business insurance,Professional indemnity,General liability insurance,e&o insurance,Business insurance,Car insurance,Insurance quotes,Insurance,Life insurance,Rental insurance,,Cheapest insurance,Insurance forbusinesses,Insurance in a business,Car insurance companies.

Personal Demographics:

Insurance companies evaluate personal demographics to assess the risk associated with an individual driver. Factors such as age, gender, marital status, and driving experience can influence insurance rates. Statistically, younger and inexperienced drivers tend to have higher accident rates, leading to higher insurance premiums. Additionally, some insurance providers may also consider credit history as a factor, as studies suggest a correlation between credit scores and the likelihood of filing claims.

Driving History:

A person’s driving history plays a crucial role in determining insurance rates. Insurance providers analyze factors such as the number of previous accidents, traffic violations, and claims history. Individuals with a history of accidents or violations are considered higher risk and may face higher premiums as a result. On the other hand, drivers with a clean record typically qualify for lower rates and may be eligible for certain discounts.

Geographic Location:

The location where a vehicle is primarily driven and parked is also taken into consideration. Insurance providers assess the local traffic patterns, crime rates, and the likelihood of accidents in a particular area. Urban areas with heavy traffic and a higher incidence of thefts or accidents may lead to higher insurance rates compared to rural or less congested regions.

Usage of the Vehicle:

How a vehicle is used can impact insurance rates as well. Insurance companies often inquire about the primary use of the vehicle, such as personal commuting, business use, or leisure activities. Mileage is another important factor, as higher mileage generally means a greater exposure to accidents. Additionally, some insurers offer usage-based insurance, where rates are determined based on actual driving behavior using telematics devices or smartphone apps.

Coverage and Deductibles:

The coverage options and deductibles selected by policyholders significantly impact the insurance premiums. Higher coverage limits and lower deductibles usually result in higher premiums, as the insurance provider assumes more risk. Conversely, opting for lower coverage limits or higher deductibles can help reduce premiums but may increase out-of-pocket expenses in the event of a claim.

Conclusion:

While the make, model, and year of a vehicle are factors that auto insurance providers consider, they are just a part of the complex equation used to calculate insurance rates. Personal demographics, driving history, geographic location, vehicle usage, and coverage choices all contribute to the determination of premiums. Understanding these factors can empower individuals to make informed decisions when selecting auto insurance and potentially find ways to save on premiums through safe driving practices, maintaining a clean driving record, or exploring available discounts. Online Motor Insurance Quotes,Donate your Car for Money,Hard drive Data Recovery Services,Donate Old Cars to Charity,Donate Car to Charity California,Donate Car for Tax Credit,Car Insurance Quotes PA,Donating Used Cars to Charity,Donating a Car in Maryland,Donate Your Car Sacramento,,Donate Your Car for Kids.