Introduction:

When it comes to protecting your vehicle, insurance coverage plays a crucial role in safeguarding your investment and providing financial security in the event of an accident. One of the key types of coverage offered by insurance companies is collision coverage. In this article, we will delve into what collision coverage entails and explore the various benefits it provides to policyholders. Car insurance quotes,Compare car insurance online,Buy car insurance online,Auto insurance,Commercial auto insurance,Small business insurance,Professional indemnity,General liability insurance,e&o insurance,Business insurance,Car insurance,Insurance quotes,Insurance,Life insurance,Rental insurance,Homeowners insurance,Cheapest insurance,Life insurance quotes,Insurance forbusinesses,Insurance in a business,Car insurance companies.

Coverage Details:

Vehicle Repair or Replacement: If your vehicle is involved in a collision and sustains damage, collision coverage will reimburse you for the cost of repairing your vehicle or replacing it if it is deemed a total loss.

Deductibles: Like other types of insurance, collision coverage typically comes with a deductible, which is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premium costs, while lower deductibles may lead to higher premiums.

Limitations: Collision coverage usually has a maximum limit that your insurance company will pay out in the event of a claim. This limit is based on the actual cash value of your vehicle, considering factors such as depreciation. It’s important to review your policy to understand the specific limits and terms associated with your coverage.

Benefits of Collision Coverage:

Vehicle Protection: Collision coverage ensures that your vehicle is protected in the event of an accident, regardless of who is at fault. This provides peace of mind and safeguards your financial investment.

Repair Costs: The cost of repairing a vehicle damaged in a collision can be substantial. With collision coverage, you can avoid the burden of these expenses and have your vehicle repaired promptly, allowing you to get back on the road quickly.

Total Loss Coverage: In cases where your vehicle is considered a total loss, collision coverage can help you receive compensation based on the actual cash value of your vehicle at the time of the accident. This compensation can go towards purchasing a new vehicle or covering other expenses.

Uninsured/Underinsured Motorist Coverage: Some collision coverage policies also include protection against accidents involving uninsured or underinsured drivers. This additional coverage ensures that you are financially protected even if the other party lacks sufficient insurance.

Considerations:

Vehicle Age and Value: Collision coverage may be more beneficial for newer vehicles or those with higher values. For older vehicles with lower values, the cost of the coverage and potential deductible may outweigh the benefits.

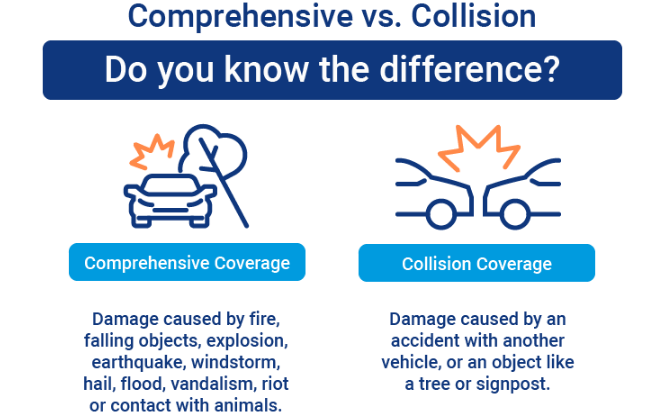

Coverage Bundling: Insurance companies often offer discounts or incentives for bundling collision coverage with other types of coverage, such as liability or comprehensive insurance. It’s worth exploring these options to potentially reduce overall insurance costs.

Conclusion:

Collision coverage is an essential component of auto insurance policies offered by insurance companies. It provides financial protection and peace of mind in the event of a collision, covering the cost of vehicle repair or replacement. Understanding the details, limitations, and benefits of collision coverage can help you make informed decisions when selecting the right insurance policy to protect your vehicle. Donate Old Cars to Charity,Forex Trading Platform,Forensics Online Course,Donate Car to Charity California,Donate Car for Tax Credit,Car Insurance Quotes PA,Email Bulk Service,Donating Used Cars to Charity,Donating a Car in Maryland,Donate Your Car Sacramento,Online Criminal Justice Degree,Donate Your Car for Kids.