Introduction:

Car insurance is a necessary expense for every vehicle owner, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. When purchasing car insurance, one of the key factors to consider is the premium—the amount you pay for coverage. Understanding the various factors that influence car insurance premiums can help you make informed decisions and potentially save money. In this article, we will explore the main elements that insurers consider when determining your car insurance premiums. Online Motor Insurance Quotes,Donate your Car for Money,Online Colleges Health Records ,Personal Health Record,Hard drive Data Recovery Services,Donate Old Cars to Charity,Forex Trading Platform,Forensics Online Course,Donate Car to Charity California,Donate Car for Tax Credit,Car Insurance Quotes PA,Email Bulk Service,Donating Used Cars to Charity,Donating a Car in Maryland,Donate Your Car Sacramento,Online Criminal Justice Degree,Donate Your Car for Kids.

Personal Factors:

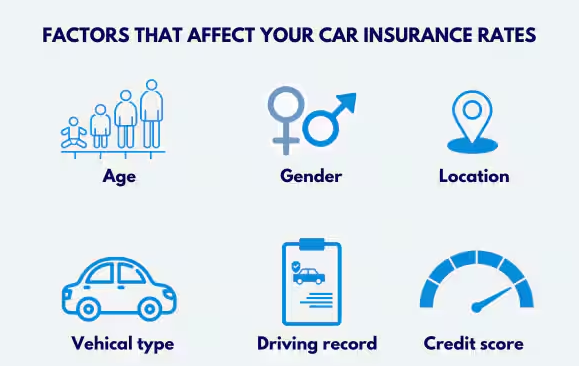

Insurers take into account several personal factors when calculating car insurance premiums. These include:

a) Age and Gender: Statistically, younger and less experienced drivers are more prone to accidents, resulting in higher premiums. Additionally, historically, men have been associated with more accidents than women, resulting in different premium rates.

b) Driving Record: Your driving history plays a significant role in determining your premium. A clean driving record with no accidents or traffic violations typically leads to lower rates, as it indicates responsible driving behavior.

c) Location: Your place of residence affects your premium due to factors such as population density, traffic congestion, and crime rates.

Vehicle-related Factors:

The characteristics of the vehicle you own or plan to insure also influence your car insurance premiums. Consider the following:

a) Vehicle Make and Model: Insurance companies evaluate the crashworthiness and repair costs of different makes and models.

b) Age of the Vehicle: Older vehicles may have lower premiums since they typically have lower market values. Newer vehicles often require higher coverage due to their higher costs of repair or replacement.

c) Safety Features: Vehicles equipped with safety features such as airbags, anti-lock brakes, and electronic stability control can earn you discounts on your premiums as they reduce the risk of injury and accidents.

Coverage Options:

The type and extent of coverage you choose significantly impact your car insurance premiums. Consider the following coverage options:

c) Deductibles: A deductible is the amount you pay out of pocket before insurance coverage kicks in. Choosing a higher deductible often results in lower premiums since you assume more risk.

Credit History:

In some jurisdictions, insurers may consider your credit history when calculating premiums. Maintaining good credit can lead to lower car insurance premiums.

Conclusion:

Car insurance premiums are influenced by a range of factors, including personal characteristics, vehicle-related factors, coverage options, and even credit history. It’s crucial to review these factors and compare quotes from multiple insurers to find the most suitable coverage at a competitive premium. Additionally, maintaining a clean driving record, opting for safety features, and considering higher deductibles can help lower your car insurance premiums. By understanding the key elements that impact your rates, you can make informed decisions and potentially save money on your car insurance policy. Car insurance quotes,Compare car insurance online,Buy car insurance online,Auto insurance,Commercial auto insurance,Small business insurance,Professional indemnity,General liability insurance,e&o insurance,Business insurance,Car insurance,Insurance quotes,Insurance,Life insurance,Rental insurance,Homeowners insurance,Cheapest insurance,Life insurance quotes,Insurance forbusinesses,Insurance in a business,Car insurance companies.