Introduction:

Car insurance is a vital component for every vehicle owner, offering financial protection against various risks on the road. While most people are familiar with the basic coverage provided by car insurance policies, they may not be aware of an additional benefit: rental car coverage. This article aims to shed light on the importance of rental car coverage, its inclusion in many car insurance policies, and how it can prove invaluable in certain situations. Donate Old Cars to Charity,Forex Trading Platform,Forensics Online Course,Donate Car to Charity California,Donate Car for Tax Credit,Car Insurance Quotes PA,Email Bulk Service,Donating Used Cars to Charity,Donating a Car in Maryland,Donate Your Car Sacramento,Online Criminal Justice Degree,Donate Your Car for Kids.

What is Rental Car Coverage?

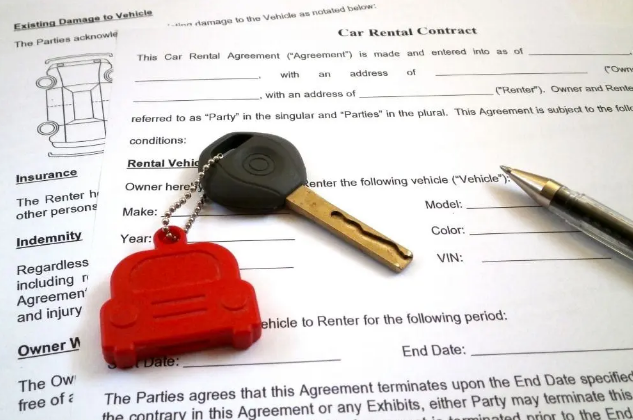

Rental car coverage, also known as rental reimbursement coverage, is an optional add-on to standard car insurance policies. It provides financial assistance for the cost of renting a replacement vehicle when your car is being repaired after an accident or due to other covered incidents. This coverage ensures that you can continue with your daily activities, such as commuting to work or running errands, even when your car is temporarily out of commission.

How Does Rental Car Coverage Work?

When you have rental car coverage as part of your car insurance policy, the insurance company will reimburse you for the expenses incurred in renting a temporary replacement vehicle. The coverage typically has a daily limit and a maximum overall reimbursement limit, which may vary depending on your specific policy. The insurance company may require you to select a rental car from a preferred provider or provide reimbursement based on the actual expenses you incurred.

Benefits of Rental Car Coverage:

a. Convenience and Mobility: Rental car coverage ensures that you have access to a temporary vehicle while your car is being repaired. This eliminates the hassle of relying on public transportation or depending on others for rides, allowing you to maintain your daily routine and commitments.

b. Cost Savings: Renting a car out of pocket can be expensive, especially if your car needs extensive repairs or if the repair process takes an extended period. Having rental car coverage can significantly reduce your out-of-pocket expenses, as the insurance company will cover or reimburse a portion of the rental costs.

c. Peace of Mind: Accidents and car repairs are stressful enough without having to worry about how you’ll get around during the process. Rental car coverage provides peace of mind, knowing that you have a temporary replacement vehicle readily available, minimizing disruptions to your life.

Limitations and Considerations:

a. Coverage Limits: Rental car coverage usually comes with specific limits on the daily rental amount and the overall reimbursement limit. Ensure that you understand these limits and choose a coverage option that meets your needs.

b. Covered Incidents: The coverage is typically applicable only for accidents or covered incidents as outlined in your policy. It may not apply to routine maintenance or damages caused by negligence or intentional acts.

c. Rental Car Restrictions: Some policies may have restrictions on the type of rental vehicle covered or require you to rent from specific providers. Familiarize yourself with any such limitations in your policy.

Conclusion:

While car insurance is primarily designed to protect your vehicle and cover damages in accidents, rental car coverage offers an additional layer of convenience and financial support during repair periods. By understanding the benefits of rental car coverage, you can make informed decisions when choosing a car insurance policy and ensure that you have the necessary protection and mobility in times of need. Remember to review your policy carefully, considering the coverage limits and any restrictions associated with rental car coverage. Car insurance quotes,Compare car insurance online,Buy car insurance online,Auto insurance,Commercial auto insurance,Small business insurance,Professional indemnity,General liability insurance,e&o insurance,Business insurance,Car insurance,Insurance quotes,Insurance,Life insurance,Rental insurance,Homeowners insurance,Cheapest insurance,Life insurance quotes,Insurance forbusinesses,Insurance in a business,Car insurance companies.