It can be frustrating to pay for insurance month after month, especially when you haven’t used it. You might feel like it’s a waste of money, but that’s far from the truth. Insurance may not be as exciting as paying off debt, but it’s essential to have a solid defense plan.

Think of insurance as a life-saving jacket. You may not appreciate it until you need it, but when you do, you’ll be grateful for having it. Insurance is all about risk transfer. Without it, you could be just one accident, illness, or emergency away from a financial disaster.

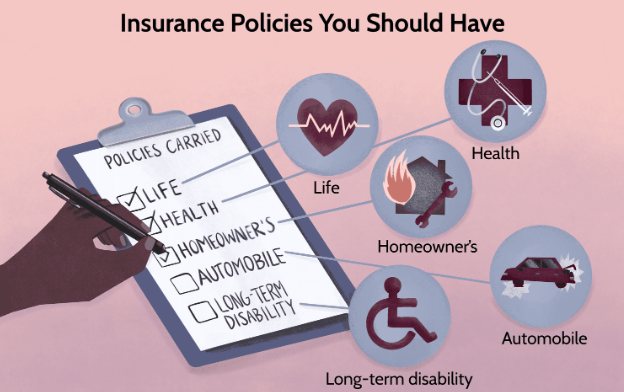

However, determining which insurance policies are necessary and which ones aren’t can be challenging. That’s why we’ve compiled a list of the eight types of insurance policies you should consider having.

Term Life Insurance: A Vital Investment for Your Future

If you are looking for just one insurance plan to prioritize, make it term life insurance. Although many people recognize the importance of life insurance, they still fail to make it a priority. Shockingly, only 54% of Americans have life insurance, according to the Insurance Information Institute. 1 Considering the certainty of death, those odds are not favorable.

Imagine what would happen if you passed away unexpectedly. How would your spouse manage to pay for monthly expenses without your income? The last thing you would want is for your grieving partner to worry about how to keep up with the mortgage payment and put food on the table after you’re gone. However, if you had a term life insurance policy that covered 10 to 12 times your yearly income, your family wouldn’t have to worry about making ends meet or altering their lifestyle in your absence.

Delaying the purchase of life insurance is a risk not worth taking. Talk to an independent insurance agent today about term life insurance. It is affordable, and the peace of mind it provides is invaluable. When shopping for life insurance, make sure you opt for term life insurance instead of whole life insurance, which can be a long-term gimmick.

If you think life insurance is unnecessary just because you are young and single, reconsider. If you have significant debt and no savings, consider getting a small term life insurance policy. Even a healthy 30-year-old can easily obtain an inexpensive policy that will at least pay off your debt and cover burial expenses. Contact Zander Insurance, one of our Ramsey-trusted providers, for a term life insurance quote.

If you are debt-free, have enough cash to cover your burial expenses, and do not have dependents, you may not require life insurance. However, consider that term life insurance is more affordable the younger you are. You will never be younger than you are today, so if it is something you believe you may require in the future, it is cheaper to purchase it now than in 15 years.

Auto Insurance: Protecting Your Vehicle and Wallet

It is not only illegal to drive without insurance but also financially unwise. Even a minor accident can result in significant costs. The Insurance Information Institute estimates the average loss per claim on cars to be approximately $1,057. That’s a significant amount of money to pay out of pocket! Fortunately, there are various auto insurance options available to protect yourself and your vehicle.

Liability coverage is mandatory insurance that covers the costs of any injuries or damages caused by you in an accident. Every state has its own minimum requirements, so check with your insurance agent to find out the appropriate amount of coverage for you.

Collision coverage pays for the cost of repairing or replacing your car if it is damaged or totaled in an accident. This type of coverage is not mandatory, but it is highly recommended, especially for newer or more expensive vehicles.

Comprehensive coverage is another optional insurance policy that provides coverage for losses not caused by a collision, such as theft, vandalism, flood, fire, and hail.

Navigating the world of auto insurance can be overwhelming, but talking to an insurance agent can simplify the process. They can help you assess your needs and find the right coverage for your car.

Homeowners or Renters Insurance: A Wise Investment

Whether you are a homeowner or renter, protecting yourself with homeowners or renters insurance is a wise investment. If you already have a homeowners policy, it is essential to check if it includes extended dwelling coverage. This type of coverage provides an additional layer of protection beyond your policy limits.

Extended dwelling coverage is an excellent option because your insurance company will replace or rebuild your property even if the cost exceeds your policy’s coverage. However, there is a limit to how much they will pay out, usually 20–25% above your insured amount, unless you opt for more coverage. It is important to note that the higher the value of your home, the greater the need for extended dwelling coverage.

For homeowners insurance, it is advisable to consult your agent to understand what your policy covers and what it does not cover. This ensures that you do not have any unpleasant surprises. Some additional coverage options you may want to consider are:

Flood insurance: Most homeowners are unaware that regular policies do not include flood insurance. It is important to note that flood insurance is different from water backup protection. An agent can help you understand and choose the best option for you.

Hurricane insurance: If you live near a body of water, you might want to consider getting hurricane insurance. Without wind insurance coverage or a separate hurricane deductible, your homeowners insurance policy will not cover hurricane damage.

Earthquake coverage: Depending on where you live in the country, earthquake coverage may not be included in your homeowner’s coverage. If you live in an area prone to earthquakes, you might want to consider adding this to your policy.

As a renter, it is also essential to protect your belongings with renter’s insurance. Without it, you will be responsible for replacing your belongings in the event of a fire, flood, burglary, or other disaster. Additionally, many landlords and apartments require renters insurance.

A useful tip is to consider taking a higher deductible and reducing your policy’s premium if you have a full emergency fund in place. This will help you save money while still ensuring that you are adequately covered.

Health insurance

Health insurance is an essential type of coverage that everyone should consider. Research by academic experts revealed that approximately 67% of people who declare bankruptcy do so because they are unable to pay off medical debt. This is a hard truth that cannot be ignored: if you do not have health insurance, you are exposing yourself to a financial disaster. A sudden medical emergency could quickly add up to hundreds of thousands of dollars in medical bills. It is crucial to have health insurance to avoid such a situation.

The high cost of medical insurance should not be a reason to forgo coverage, even if you do not visit the doctor frequently. You can lower the cost of health insurance by opting for a high-deductible plan. With this plan, you pay more of your up-front healthcare costs, but your monthly premiums will be lower. Additionally, you can open a Health Savings Account (HSA), which is a tax-advantaged savings account used for medical expenses.

We highly recommend HSAs for their numerous benefits. For instance, you can deduct HSA contributions from your gross pay or business income, and in 2022, the tax deduction will be $1,400 for singles and $2,800 for a family. Funds you contribute to your HSA can be invested, and they grow tax-free for you to use now or in the future. You can also use the money tax-free to pay for qualified medical expenses such as health insurance deductibles, vision, and dental.

Some companies now offer high-deductible health plans with HSA accounts in addition to traditional health insurance plans. It is important to consider your options and see if a high-deductible plan could save you money. An independent insurance agent can provide guidance on high-deductible health plan options that can be combined with an HSA.

Long-Term Disability Insurance

Long-term disability insurance is a type of insurance that safeguards your income in case you become unable to work due to an extended period of illness or injury. It’s easy to assume that a permanent disability won’t happen to you and that you will always be able to work, but statistics show otherwise. In fact, the Social Security Administration estimates that over 25% of individuals in their twenties today will suffer a disability before they turn 67.5 years old. With such high chances of disability, it is essential not to underestimate the importance of long-term disability insurance.

If you are in the prime of your income-earning years, a permanent disability can wreak havoc on your finances, delaying or even derailing your dreams of owning a home or paying for your children’s college education. Therefore, it is crucial to ensure that you have adequate coverage in the event of such an event. Thankfully, many companies offer long-term disability insurance to their employees nowadays, making it easier to obtain this essential coverage.

When evaluating your options, you may also come across short-term disability insurance, which covers income gaps caused by illness or injury that keep you out of work for three to six months. However, if you have a fully funded emergency fund, you may not require this type of insurance coverage. Instead, it is better to focus on obtaining long-term disability insurance to protect yourself against this more significant financial risk.

To determine what other insurance coverage you may need, consider taking our quick coverage checkup. In conclusion, the chances of becoming disabled before retirement age are much higher than you might think, and the potential financial consequences are significant. Therefore, it is essential to make sure that you have adequate long-term disability insurance coverage to protect your income and your future.

Long-Term Care Insurance

Long-term care insurance covers a ton of services like nursing home care and in-home help with basic personal tasks (bathing, grooming, and eating). Usually, long-term care means those who have a chronic illness or disability need ongoing help. If it sounds expensive, that’s because it is. And long-term care costs aren’t usually covered by Medicare either.

So, who really needs long-term care? To protect your retirement savings from getting drained by long-term care, get this coverage when you turn 60. Remember that while you probably won’t need long-term care before then, a lot of factors (like your health and family history) go into your decision of when to buy long-term care insurance—and how much you’ll pay for it.

That’s why it’s important to talk to a Ramsey-trusted professional, like an endorsed local provider, about long-term care that fits your situation. And even if you’re not at this stage of life, your parents might be. So bite the bullet and take time to talk with them about their long-term care options too.

Long-Term Care Insurance: Understanding Your Options

Long-term care insurance is designed to cover a range of services, including nursing home care and in-home assistance with daily tasks such as bathing, grooming, and eating. Typically, long-term care is required by individuals with chronic illnesses or disabilities who need ongoing assistance. Although this type of insurance may seem costly, it is important to note that long-term care costs are not usually covered by Medicare.

So, who exactly needs long-term care insurance? If you want to safeguard your retirement savings from being depleted by long-term care costs, it is recommended that you purchase this coverage when you reach 60 years of age. While it is unlikely that you will need long-term care before this age, various factors, such as your health and family history, should be taken into consideration when deciding when to purchase long-term care insurance and how much you will need to pay for it.

To make an informed decision that suits your unique situation, it is important to consult with a trusted professional, like an endorsed local provider from RamseyTrusted, about your long-term care options. Even if you are not yet at the stage of life where you require long-term care, your parents might be. Therefore, it is crucial to have an open and honest conversation with them about their long-term care options.

Identity Theft Protection

Identity theft is a serious issue, and even if you are cautious about safeguarding your personal information, it can happen to anyone. Shockingly, the 2021 Identity Fraud Study by Javelin Strategy and Research revealed that identity theft losses reached a staggering $56 billion in 2020. The constant news about data breaches and cyberattacks on retail stores’ payment systems adds to the increasing concern about this crime.

The scary thing is that with just a few pieces of personal information, fraudsters can cause significant financial damage. They can open credit lines, file false tax returns, or even take out a mortgage in your name. The aftermath of identity theft is an extensive and complex process that could take several years to resolve independently.

Therefore, it’s crucial to ensure that your insurance coverage includes identity theft protection services that can assist you in cleaning up the mess caused by the fraudsters. Such services will save you the trouble of dealing with the repercussions of identity theft on your own and provide you with much-needed peace of mind.